Global AI Spending to Top $2T by 2026, Driven by GenAI Phones and AI Servers

AI-optimized servers are projected to see the fastest growth at $189.4 billion, while GenAI models show the smallest increase at $20 billion.

Topics

News

- TII and Qualcomm Bet on Edge AI to Move Autonomous Systems Out of the Lab

- Musk Predicts AI Will Outpace Human Intelligence by 2026

- UAE Companies Double Down on AI, but Gaps Persist: Report

- AI Robotics is a ‘Once-in-a-Generation’ Opportunity for Europe, Says Jensen Huang

- WEF and TII Announce Abu Dhabi Centre for Frontier R&D and Policy

- CrowdStrike Expands In-Country Clouds Across Saudi Arabia, India, and the UAE

[Image source: Chetan Jha/MITSMR Middle East]

Gartner projects global AI spending will near $1.5 trillion by 2025, fueled by strong demand across IT infrastructure, applications, and consumer devices.

”The forecast assumes continued investment in AI infrastructure expansion, as major hyperscalers continue to increase investments in data centers with AI-optimized hardware and GPUs to scale their services,” said John-David Lovelock, Research Vice President at Gartner.

Largely driven by the integration of AI into mainstream consumer products, such as smartphones and PCs, as well as the expansion of infrastructure adoption, the report predicts that total AI spending will surpass $2 trillion by 2026.

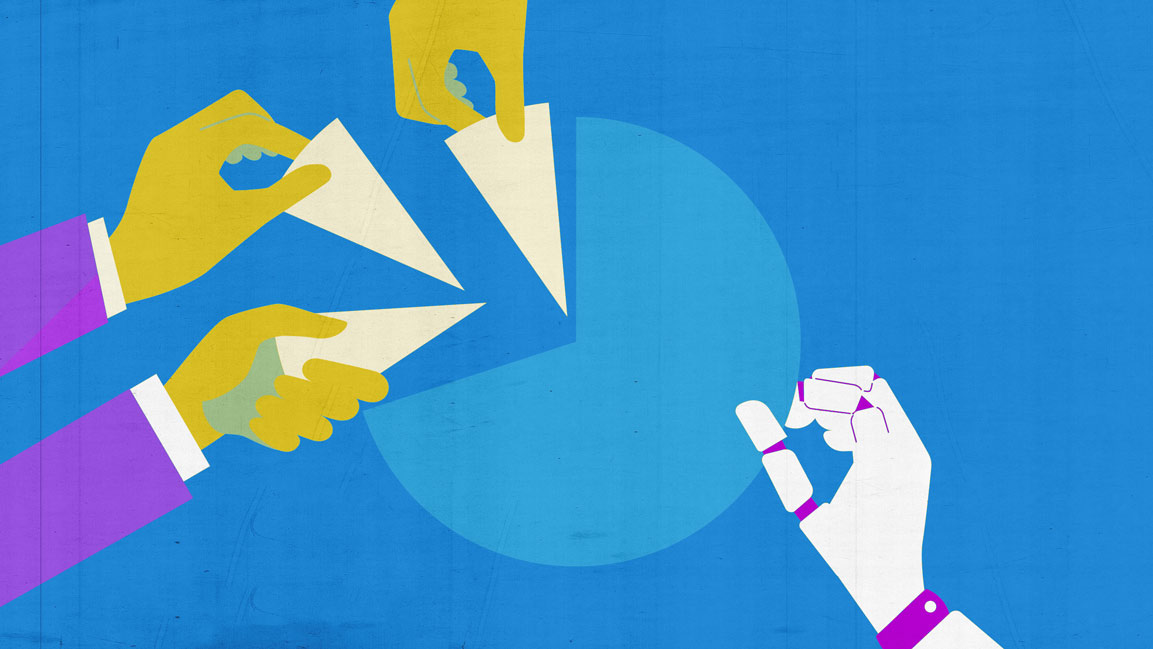

In 2024, global AI spending touched $987,904, led by AI services at $259.5 billion and generative AI smartphones at $244.7 billion. Hardware investments were strong, with AI-optimized servers hitting $140.1 billion and AI processing semiconductors at $138.8 billion. On the software side, AI applications drew $83.7 billion and infrastructure software $56.9 billion, while emerging areas like AI PCs ($51.0 billion), AI-optimized IaaS ($7.4 billion), and generative AI models ($5.6 billion) showed fast-growing potential.

By 2026, GenAI smartphones are expected to touch $393.2 billion, with AI-optimized servers gaining momentum to reach $329.5 billion. As conversational AI becomes a norm in the future, users are expected to become more comfortable with AI as a proactive digital companion. The growth will be propelled by vendors increasingly integrating on-device GenAI models and applications.

The fastest-growing segment in terms of absolute spending is expected to be AI-optimized servers, while GenAI Models show the least absolute growth during this span, growing $189.4 billion and $20 billion, respectively.

“The AI investment landscape is also expanding beyond traditional U.S. tech giants, including Chinese companies and new AI cloud providers. Furthermore, venture capital investment in AI providers is providing additional tailwinds for AI spending,” Lovelock added.