Make Better Allies of Your Workforce

Leaders can avoid labor disputes and create value by improving communication with employees and including them in strategic decision-making.

News

- Dubai Media Enters Streaming Space With Dubai+, a Local-First OTT Platform

- MBZUAI Unveils K2 Think V2, Advancing the UAE’s Push for Fully Sovereign AI

- ENEC, TII, and ASPIRE Partner to Advance Autonomous Aerial Systems

- OpenAI Bets on AI to Streamline Scientific Research Workflows

- AI Use Is Rising at Work but Productivity Gains Lag

- Meta Signals Shift Toward Paid Features With Subscription Tests Across Its Apps

Neil Webb/theispot.com

Amid economic uncertainty, supply chain restructuring, and a new wave of automation, businesses that once engaged in extensive hiring now face significant layoffs. Many companies are rolling back flexible work arrangements prompted by the pandemic.1 Meanwhile, employees increasingly want to see their own values and priorities represented in how their companies operate.2 And since the pandemic, many are redrawing the boundaries between work and their personal lives to protect their own well-being.

These trends have intensified tensions between American workers and corporate leaders, leading to a gradual erosion of trust and an increasing strain in their relationships.3 We can see this both directly, in the rise of workforce controversies, such as strikes and other disputes over wages, working conditions, diversity, equal opportunity, health, and safety; and indirectly, through employee disengagement.4

Besides inducing costly operational disruptions and lowering the quality of work, labor controversies and disengagement pose significant challenges for businesses in attracting and retaining talent. Furthermore, such controversies hinder companies’ ability to navigate business challenges like cybersecurity, digitalization, and sustainability, which demand vigilance from and collaboration with employees.

Our analysis of the top 50 public corporations in Germany reveals that, despite a long-standing tradition of involving employees on company boards, management’s ability to manage workforce disputes and foster employee engagement varies. We found that the structure and composition of boards have little to do with their effectiveness; rather, what matters most for reducing conflict is the extent to which C-suite and board leaders actively engage employees in critical strategic decisions. (See “The Research.”) We interviewed key stakeholders in companies that had experienced fewer workforce controversies. Through our conversations with board directors, CEOs, CFOs, and employee representatives in a range of sectors, we identified three strategies such leaders use to include employees: They identify mutual goals and interests, foster inclusive decision processes, and give employees strategic responsibilities.

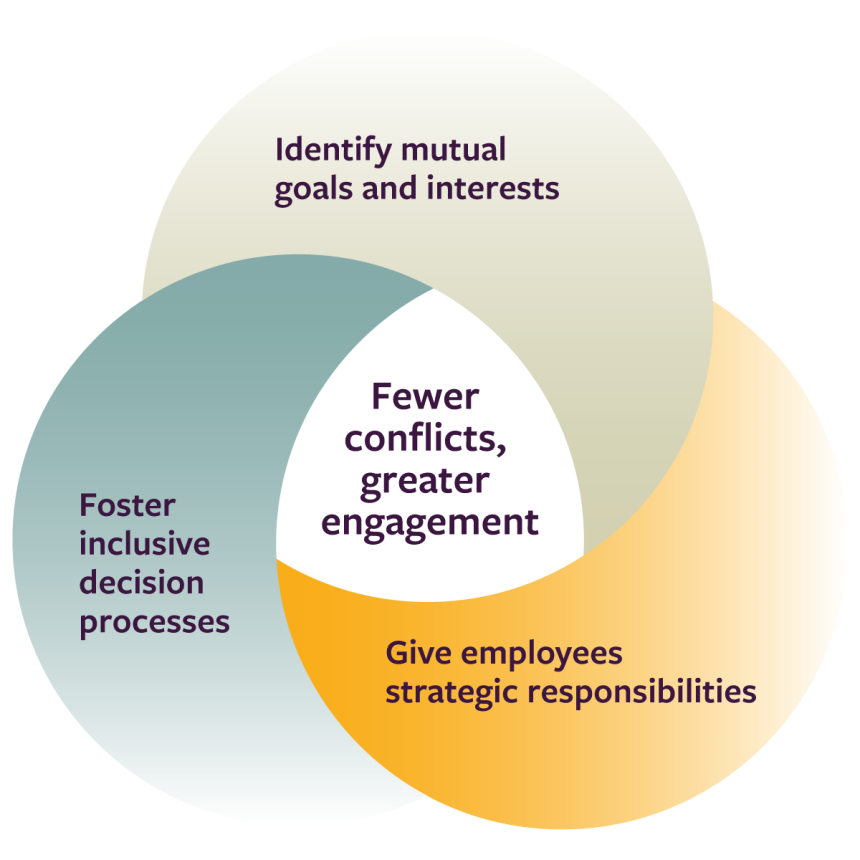

The strategies facilitate active collaboration among C-suite leaders, external directors, and employees on critical issues while simultaneously fostering trust among the three groups. (See “Three Strategies to Avert Workforce Controversies.”)

Three Strategies to Avert Workforce Controversies

When companies focus on employees’ and leaders’ common interests, include employees when making decisions, and give employees responsibility for developing business strategy along with senior managers, they can increase engagement and make workforce controversies less likely.

Leaders who employ these strategies can more effectively address a broad spectrum of strategic issues, including business model transformations, restructurings, mergers and acquisitions, divestments, spinoffs, technology adoption, environmental sustainability, and social concerns. Meanwhile, establishing a solid foundation for tackling problems can set the stage for the workforce to join management in value creation.

Companies in any region can harness these benefits, even if they lack a formal structure, such as board representation, for involving employees in decisions. While the research focused on companies that have employee representation on their boards, at the end of the article we will explain how companies without such structures can incorporate these strategies into their existing decision-making processes.

1. Identify Mutual Goals and Interests

Corporate leaders often overlook the fact that employees have a significant stake in their company’s long-term success — after all, they depend on it for their livelihoods and, often, their future security. But the companies in our sample with the fewest workforce controversies recognize and capitalize on the inherent connection between employees’ interests and those of the organization. Leaders in these companies make the effort to identify shared objectives and focus on how to achieve them in ways that address both management and employee concerns. Rather than approaching potential conflicts as negotiations between two opposing sides, they frame such situations as joint problems to solve. In doing so, they create a shared sense of ownership and responsibility for finding solutions.

Moreover, these companies deviate from the conventional practice of making HR executives chiefly responsible for communication with employees. In the companies we studied, CEOs and CFOs directly engaged with employee board representatives to explain the rationale behind potentially controversial decisions before presenting those decisions to the full board. According to Herbert Hainer, a former CEO of Adidas and a director on several U.S. and European corporate boards, open and transparent communication from the CEO can give employees the broader context for decisions and help them align with company goals.

Wolfgang Ziebart, chair of the board at wind-turbine maker Nordex and former CEO of semiconductor manufacturer Infineon Technologies, advises emphasizing the potential consequences if board members, C-suite leaders, and employee representatives focus solely on their own group’s rights and agendas. “Everyone would stand to lose in the long run,” he observed.

A restructuring effort by ThyssenKrupp, an industrial engineering and steel manufacturing conglomerate, illustrates the repercussions when a coherent communication strategy is lacking. In 2019, in response to global changes in the sectors where ThyssenKrupp competed, CEO Martina Merz laid out an ambitious plan that entailed the sale of three core businesses: elevator manufacturing, marine systems, and steel. After thorough discussions, the board and employee representatives agreed to the plan.

ThyssenKrupp divested the elevator business in 2020 for $20.4 billion. Subsequent efforts to sell the steel division failed. Although management explored a range of options for both the steel and marine divisions for over two years, including sales, government equity partnerships, and an initial public offering (IPO), they never presented a concrete plan to the board.

That ambiguity prevented the employee representatives from assessing and addressing workers’ concerns, and their frustrations resonated with the board. In a March 2023 memo to ThyssenKrupp’s 100,000 workers, the employee representatives criticized management for a lack of vision and for wasting time.5 A week later, Merz resigned. Four months later, the CFO announced his intention to leave when his contract expired.

ThyssenKrupp employees didn’t resist the restructuring. On the contrary, they wanted to see the company adapt successfully to changes in its industry. They supported the initial plan even though tens of thousands of workers would be affected — 26,000 in the steel division alone. And they did not withdraw their support for the goal. Management’s failure to communicate and involve employees created the controversy.

In contrast, when financial services provider Allianz changed its core business model, company leaders ensured that employees understood and were persuaded by the reasons behind the change and its timing.6

Leaders at every level in the organization participated in the communications effort, including the global heads of business transformation and strategic workforce planning, the CEOs of Allianz companies in 30 countries, and the leaders of the operating entities within those companies. They explained what the shift would mean for employees, including what current and future roles would look like under the new business model. They also provided a timeline for the change process, along with concrete milestones and how they would be evaluated.

This approach enabled company leaders to gain the crucial support of employee representatives on the Allianz board, which proved vital for the successful rollout of the reconfigured organization, products, and services.

When companies communicate with employees and involve them in decisions about sensitive issues, they gain their trust, even when an initiative does not succeed. Harald Kern, a longtime employee director at Siemens, Europe’s largest industrial manufacturing company, recounted a proposed merger between Siemens Mobility and aircraft maker Bombardier. Siemens’s employee representatives found it challenging to quickly comprehend management’s intentions and anticipate the repercussions for the company and its workforce. To help them learn the motives behind the merger decision, management supplemented company information with insights from industry analysts.

Ultimately, external factors impeded the merger. But Kern said that management’s commitment to open dialogue and sharing resources solidified employees’ trust in Siemens’s leaders.

2. Foster Inclusive Decision Processes

Corporate leaders often prioritize results over how they achieve them. However, we found that companies that take deliberate steps to include employees when making decisions experience fewer workforce controversies.

In 2020, Siemens spun off its energy business, a unit with nearly 100,000 employees that represented 40% of the company’s sales. In the preliminary discussions about the decision by the board, employee representatives raised concerns that are typical in such an uncertain situation, such as potential job insecurity and changes to employee roles. Management not only responded to these concerns but also shared information about the strategic and financial challenges the energy division faced. As employees gained deeper insight, they came to view the spinoff as the most viable solution, and the potential for conflict in later stages of the process were significantly reduced. According to Robert Kensbock, the general chairman of the works council for Siemens Energy, “While there were risks, the growth opportunities outweighed them.”7

By engaging employees from the outset, Siemens’s management not only secured their support but also gained deeper insights into business operations as their plans unfolded. The employees offered recommendations for improving efficiency and reallocating those cost savings to employee training.

Moreover, they suggested and championed the transformation of a plant that specialized in building oil and gas turbines into an innovation hub that would concentrate on developing power generation and transmission technologies for plants using renewable energy sources. After the IPO, the plant introduced pioneering innovations that have earned Siemens Energy national acclaim and positioned the company as a leader in the renewable energy industry.8

In this and other cases we studied, the behavior of the board, starting with its chair, both set the tone for employee participation and determined how it would be received. When the board chair actively invites employees to critique management plans, keeps an open mind, and seeks to understand their perspectives, employees are more likely to accept, understand, and effectively navigate the challenges of the restructuring process, according to an interviewee with experience revamping companies in multiple industries. Another interviewee, who has served on multiple German boards and was a nonexecutive director at Goldman Sachs International, emphasized that this approach should be embraced by all shareholder representatives, not only the board chair.

Additionally, our interviews indicated that board chairs in companies with the fewest workforce controversies take steps to ensure that all employees feel comfortable and respected and that their contributions are valued equally. Our interviewees identified several effective practices in companies where employee representatives have a seat on the board, including the following:

- Arrange directors’ seating in alphabetical order to prevent easy identification of their respective roles as shareholder or employee representatives.

- Alternately, regularly rotate seats so that employee representatives sit next to different shareholder directors at each board meeting.

- Coach new employee representatives so that they feel comfortable and learn how to be effective during board deliberations.

- Assign shareholder directors as mentors to guide development of employees’ boardroom skills.

Board chairs might go even further and require each shareholder director to have lunch or dinner with two employee representatives every three to six months, thus creating opportunities for informal discussions outside the boardroom. One board chair we interviewed holds social events like holiday dinners to foster a more inclusive atmosphere. Our interviews indicate that these practices improve social cohesion among board members who otherwise would not naturally spend time getting to know each other as individuals.

According to Stephan Gemkow, a nonexecutive director at Airbus, when the board commits to including employees in key decisions, the entire decision-making process becomes more collaborative. Instead of structuring board activity around a rigid agenda driven by the priorities of shareholder members or management, the chair becomes a facilitator who encourages open discussions, invites diverse perspectives, and cultivates an environment where all members actively contribute. Such an approach is necessary, Gemkow said, to discover innovative solutions to complex strategic problems, such as how to address layoffs during a restructuring.

3. Give Employees Strategic Responsibilities

Our research reveals that companies with fewer workforce controversies strive to close the power gap between employees, leadership, and shareholder representatives by giving employee representatives strategic roles and responsibilities, both in formal committees and through informal channels.

Board committees are where the action is. Members perform rigorous research on and analysis of the issues in their domain, meet with key people in the organization, and develop recommendations for action by the full board. They have power to shape the board’s agenda and influence its decisions.

In the framework of German corporate governance, boards have substantial autonomy when appointing employee representatives to committees. We found a direct relationship between the proportion of employee representatives serving on board committees and the number of workforce controversies a company has faced.

Among companies with no workforce controversies in the past five years, an average of 70% of employee representatives are on board committees. In contrast, companies that faced five or more controversies in this time frame include an average of only 38% of employee representatives on board committees. Furthermore, when employee representatives are assigned to strategic board committees such as finance or technology in addition to those that primarily focus on employee or nonstrategic matters, companies also experience significantly fewer workforce controversies.

The companies that scored highest in our analysis — with the fewest workforce controversies — include logistics provider DHL, telecommunications carrier Deutsche Telekom, and software maker SAP. At all three companies, a large majority of employee representatives served on board committees: 80% at DHL, 89% at SAP, and 100% at Deutsche Telekom. And they were members of strategic committees, such as finance and investment, technology and innovation, strategy, and sustainability, in addition to narrowly focused audit and personnel committees.

In contrast, Volkswagen and Lufthansa were among the companies with the most workforce controversies during our study period. At Volkswagen, only half of the employee representatives served on board committees, while at Lufthansa, 40% did. Furthermore, at each company, employee representatives predominantly served on less-strategic committees, such as audit.9

When employee representatives serve on a greater number and a wider range of committees, they develop a deep understanding of the company’s overall strategic and financial requirements. Not only can they effectively influence decisions, but they can also assume greater responsibility for implementing them.

Such arrangements foster healthy checks and balances by promoting transparency and objectivity. They also ensure that shareholder directors obtain firsthand information from employees about potential long-term repercussions of management decisions while they are being considered. Specifically, employee representatives can alert external directors to critical risks from supply chain disruptions, production inefficiencies, investment backlogs, and employee turnover trends.

Employee and shareholder representatives we interviewed said that employees, when empowered with strategic responsibilities, can also help companies address long-term goals such as integrating sustainability into corporate systems and processes and maintaining continuity in leadership succession decisions.

For example, at Bayer, employee and shareholder representatives have equal representation on the committee that oversees key performance indicators and executive compensation, including the CEO’s. Employee representatives have influenced the inclusion of incentives to encourage top executives to pursue sustainability goals. In 2021, the committee recommended that 20% of the CEO’s compensation be based on progress toward six goals related to environmental, social, and governance (ESG) factors, including providing support for sustainable agriculture and the health and well-being of women globally, and addressing climate change through emissions-reduction or -offset initiatives.

The Siemens board goes further. It facilitates meetings between employee representatives and managers two levels below the C-suite who are being considered for executive roles. This practice allows employee representatives to evaluate the capabilities and profiles of potential future leaders, assess their alignment with the company’s values, and establish a foundation for collaboration with them in the future. Importantly, this initiative sends a strong message to employees that they are valued partners in shaping the company’s future leadership.

Many Ways to Include Employees

There are multiple avenues for companies to integrate employees into strategic decision-making, even when they don’t have a formal structure for doing so, such as employee representation on the board. Below, we suggest some alternative approaches for executing each of the three strategies.

Committees and task forces. A committee or task force that includes employees and management can be pivotal to operationalizing our first two strategies — identifying mutual goals and interests and fostering inclusive decision processes. When a company has a defined project or problem to solve, such as deciding the fate of a business unit, such groups enable employees to communicate their concerns and suggestions directly to company leaders. In addition, the CEO and CFO get an opportunity to clarify the strategic and financial logic behind crucial decisions.

Committees should include both the senior executives who are responsible for formulating and implementing the plans under discussion and employees who represent the units most likely to be affected. The employees should be selected by their peers to ensure that they reflect the perspectives of those who are closely linked to the outcomes of leaders’ decisions.

Ideally, leaders will involve employees from the start of their deliberations. In this way, they demonstrate to the entire organization both the value of the committee and their commitment to inclusive decision-making. This will signal that employees are at the table and in the game.

Engagement with board members. Employees can be invited to board meetings or retreats to foster more inclusive decision processes. Doing so can expose external directors to perspectives and information that they might not get from company leaders.

For instance, at a regular board meeting, key employees can share the operational and cultural integration issues their peers are experiencing after a merger. At a special board meeting or retreat, employees from across the organization can share their insights and expertise on broader topics. If, for example, the board is meeting to explore opportunities for automation, employees can weigh in on the practicality and applicability of proposed initiatives and recommend solutions for affected roles.

Employee advisory groups. Employee advisory groups provide a way to give employees strategic responsibility. Unlike committees and task forces, advisory groups are designed to function over the long term. They typically focus on broad organizational issues, including how employees feel about the company and their jobs. Because these groups play a role in helping their organizations respond to the values, concerns, and aspirations of the workforce, they can be charged with developing and recommending solutions for both ongoing concerns and the future direction of the company.

For example, a digital transformation advisory group that includes IT, marketing, and operations employees can continuously assess the impact of emerging technologies such as artificial intelligence, oversee the implementation of digital initiatives, and advise on digital strategy, thus ensuring that the organization remains nimble and competitive.

Similarly, an advisory group of employees from business areas that are adept at environmental compliance and sustainability practices can guide the organization’s approach and initiatives in those areas to ensure compliance with ESG standards.

When the board takes the recommendations of employee advisory groups seriously and incorporates them into decisions, employees become more empowered, and their perspectives become embedded into their company’s long-term objectives.

Our analysis of leading German companies shows the benefits when board directors and company leaders are open to employee input into strategic decisions and are willing to give them an influential role. They can not only more effectively address workforce and labor issues but also, by tapping into employees’ interests in the long-term success of the business, gain insights that make them more resilient.

Employees’ participation on committees, task forces, and employee advisory councils, and engagement with board members can help companies foster stronger relationships between directors or corporate leaders and their workforces while gaining the benefits from the insights that employees bring to corporate decision-making and governance.

Organizations that embrace these practices can cultivate collaborative, equitable, and inclusive decision-making at the highest levels.

References

- E. Goldberg, “Return to Office Enters the Desperation Phase,” The New York Times, June 20, 2023, www.nytimes.com.

- A. De Smet, B. Dowling, B. Hancock, et al., “The Great Attrition Is Making Hiring Harder. Are You Searching the Right Talent Pools?” McKinsey Quarterly, July 13, 2022, www.mckinsey.com.

- C. O’Donovan and N. Nix, “Amazon Employees Plan to Walk Off the Job as Tech Worker Tension Rises,” May 22, 2023, www.washingtonpost.com.

- P. Santilli, “The U.S. Lost 4.1 Million Days of Work Last Month to Strikes,” The Wall Street Journal, Sept. 16, 2023, www.wsj.com; J. Bersin, “Don’t Let Quiet Quitting Harm Your Career,” MIT Sloan Management Review, April 10, 2023, https://sloanreview.mit.edu; and A. Reichheld and A. Dunlop, “How to Build a High-Trust Workplace,” MIT Sloan Management Review, Jan. 24, 2023, https://sloanreview.mit.edu.

- P. Nilsson and W. Louch, “ThyssenKrupp Revives Sale of Submarine and Marine Systems Unit,” Financial Times, March 31, 2023, www.ft.com.

- J. Sperling-Magro, “Tackling Transformation at Allianz: A Holistic Approach to Change,” McKinsey & Co., May 10, 2022, www.mckinsey.com.

- A. Höpner and K. Witsch, “Siemens Energy — ein Börsengang mit Risiken,” Handelsblatt, Sept. 28, 2020, www.handelsblatt.com.

- F. Meßing, “Neue Stellen: Siemens in Mülheim Treibt die Energiewende,” Westdeutsche Allgemeine Zeitung, June 26, 2023, www.waz.de.

- It is noteworthy that in 2023, Lufthansa established a board committee focused on ESG matters and assigned two employee representatives to this committee, thereby elevating their strategic roles within the board.